Chatham University continues to address its relatively high deficit as it expands efforts to improve the financial health of the University.

The chair of the Board of Trustees sent an email March 10 updating the Chatham community on issues discussed by the Board during its latest meeting. Among the issues raised was the University’s debt and plans to decrease it by possibly selling unused real estate to lower maintenance costs.

“Chatham’s debt is comparatively high for an institution of our size, and we are working with President [Rhonda] Phillips and the leadership team on ways to reduce debt levels and the related annual payments,” Kent McElhattan, Board of Trustees chair, said in the email to students, faculty and staff.

As Chatham continues to work on lowering its budget deficit, which is less than 6 million according to McElhattan, the University debt is another critical topic for the board.

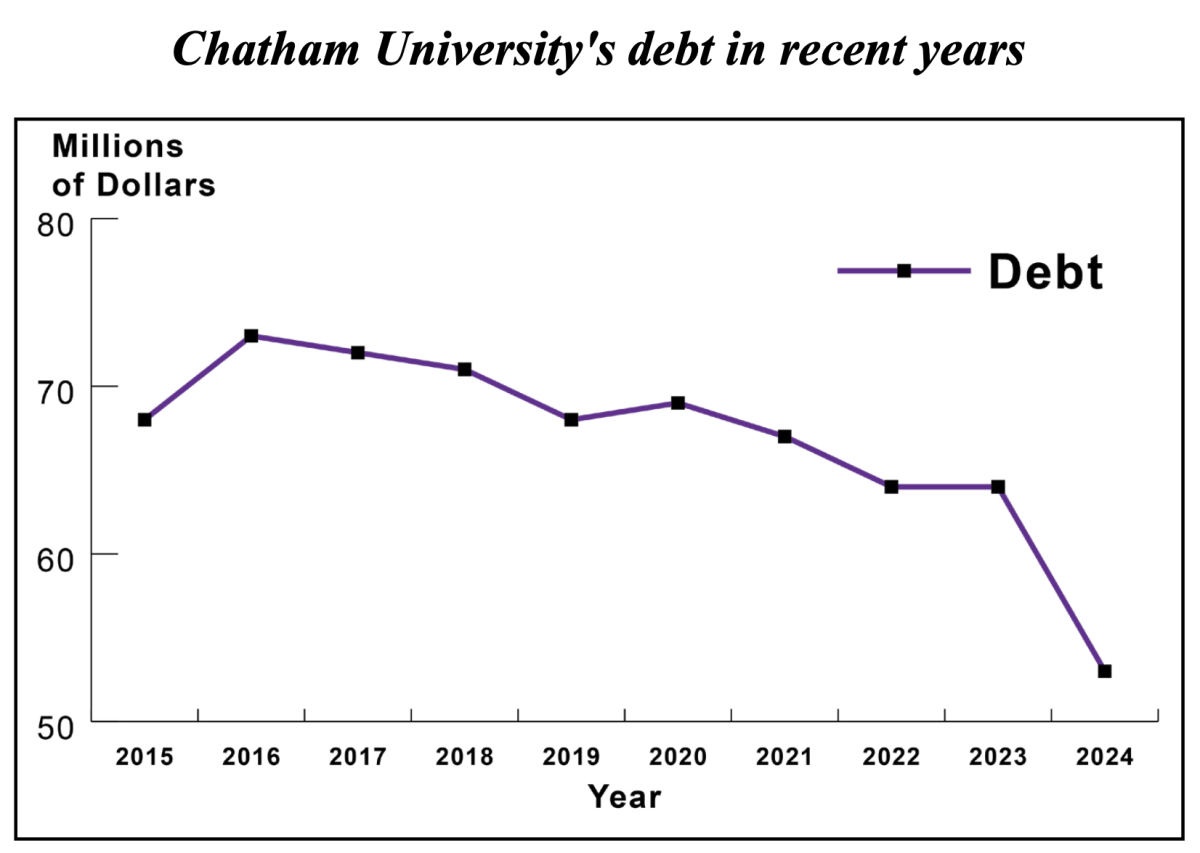

Chatham had a debt of $53 million at the end of the 2023-2024 fiscal year, according to Chatham Chief Financial and Administrative Officer Leonard Cullo. This is down from $64 million the previous year, continuing a trend of decreasing debt since it peaked in 2016.

Cullo said that bringing in more revenue is the direct way to reduce the debt, but selling real estate is effective in the short-term.

“Some of these houses that we’re not using for student housing or for any other offices or things like that around the campus, we could sell [those buildings] and that would help potentially reduce the debt,” Cullo said.

A significant part of the savings would come from maintenance costs from the old buildings on the Shadyside campus.

“We have a beautiful campus, in the middle of the city, and the old buildings that look beautiful, [but] the old buildings do take upkeep,” Cullo said. “Doing things that could avoid us having to pay for the upkeep could be helpful to the bottom line.”

The first suggestion of an ongoing review of the University’s real estate has recommended listing a vacant residential property at 21 West Woodland Road for sale.

In the long-term, Chatham is looking to bring in more revenue by increasing enrollment.

“I think they’re looking to grow both undergrad and graduate, and generally you don’t want to raise your prices when you really want to grow [the student body],” Cullo said. “If our costs were to go up, then we need to look at that and try and cover it. I think our best way to make more revenue, which is very important, would be to get more students.”

In the meantime, Chatham isn’t likely to be incurring new debt, according to Cullo.

Chatham’s debt is fixed rate. That means the interest Chatham pays will not be affected by increasing inflation or other economic factors. This leaves the monthly payments predictable and makes it easier for the Board of Trustees to plan for the future.

“Despite the challenges facing higher education institutions today, the Trustees remain committed to Chatham’s mission and future. We are not naïve about the sector’s headwinds, but we also see exciting opportunities to innovate, strengthen our financial position, and enhance the student experience,” McElhattan said in the March 10 email from the Board of Trustees.