Money-saving tips for students, by a student

September 30, 2018

By Iris Marzolf

Maybe you want to be mindful of how much money you spend. Maybe you simply don’t have the money. Or maybe you’re just cheaper than Mr. Krabs from “SpongeBob SquarePants.”

Here are some ways to make the most out of living on a student budget:

Buy textbooks wisely: Have you ever spent money on a textbook, only to pass the class without touching it? New rule of thumb: don’t buy textbooks unless you need them to be new, or if there’s an access code that you are required to use to complete assignments. If that is the case, search Amazon.com for more affordable options. Renting books is another good option, but there are ways to avoid spending money at all. The Jennie King Mellon Library offers a program called E-Z Borrow, which allows students to borrow books from neighboring libraries and universities. The books usually take up to a week to arrive and are due at the end of the semester. If you can’t find a book through E-Z Borrow, try using ILLiad. It’s similar to E-Z Borrow, but with longer wait times and earlier return dates. If all else fails, it is a good last resort.

Shop smart: Knowing the right places to shop can save you money. For instance, Target is appealing because it’s within walking distance to Chatham and offers lots of variety, from food selections to trendy dorm furniture. (But it also can be expensive at times, unfortunately.) For students living in apartments, ALDI is a smart choice because it carries groceries and household amenities at very low prices. Walmart also is great because shoppers can buy products in bulk and don’t need to pay for a membership like at Sam’s Club or Costco. Some businesses, such as J. Crew, Subway and Apple, offer student discounts and deals.

Eat wisely: Contrary to the college stereotype, you don’t have to survive off ramen during your whole college career. If living on campus, choose the least costly meal plan you can get away with. Limit eating out, buying junk food and relying on snacks from vending machines. Those purchases add up. If you have a meal plan, then use it. If you love coffee, invest in a coffee maker rather than forking over money at Café Rachel each day.

Convenience costs money: Don’t head straight to the campus bookstore to fulfill your student needs. Quick, easy access to books, lanyards, snacks and other items is nice, but the convenience is reflected in prices. Consider other (more wallet-friendly) options first.

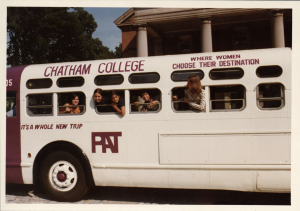

Sharing is caring: Living with a roommate lowers the cost of day-to-day expenses. However, even if you live by yourself, there are ways to save money. Whether it be carpooling to the store to save on gas, taking the bus (with students’ free bus passes), or sharing a textbook to split the cost, life is easier when there’s someone else to bear the burden with you.